What is financial planning?

It is how you optimize your limited resources of time and money across unlimited choices.

I believe this can be done when the financial planning engagement is R.E.A.L.

The advisor must be relatable.

The advisor must be empathetic.

The advisor must be attentive.

The advisor must be a listener.

Without these 4 characteristics, you will likely have a bad experience with financial advice and planning.

Who do we help?

Busy, high performers that understand the value of their time. They are willing to outsource a part of their life they don’t understand well so that they can focus on other high-payoff activities that they enjoy.

Our clients aren’t usually unable to handle their finances, just unwilling since they understand the cost of a bad decision.

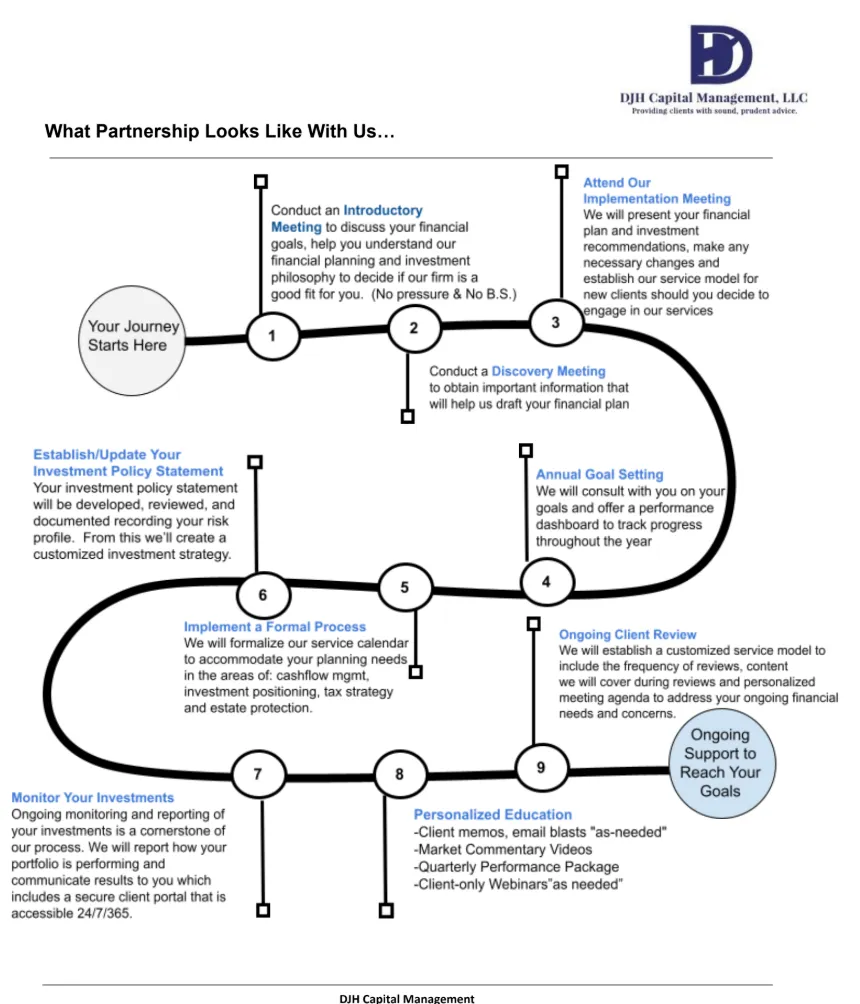

What’s your process?

All engagements begin with “discovery”. We want to understand your situation so we can determine whether our expertise will be a benefit to you.

The discovery meeting is a 60-minute meeting that is conducted virtually. During that time we will collaborate on an engagement proposal while we uncover more of your needs and goals. You’ll get a copy of that proposal along with a video recording of our meeting to help make your decision.

What’s our investment philosophy?

At DJH Capital Management, we believe retirement should feel like a graduation—full of choice, purpose, and peace of mind—rather than a downgrade.

That’s why we built the Wealth Allocation Framework™, a four-step system designed to deliver reliable income while protecting against market swings:

Build Your Safety Warchest™

We set aside 2–5 years’ worth of living expenses in highly liquid, low-volatility assets (cash, short-term bonds, permanent life insurance cash value). This “Reserve Jar” gives you uninterrupted spending even when markets dip—so you never have to cut back on what matters most.

Set a North-Star Withdrawal

We calculate your initial withdrawal based on your portfolio size and income goals (typically 5–6%). This “base allowance” becomes your guide for predictable annual income.

Apply Dynamic Guardrails

Using rules pioneered by Guyton & Klinger (read more here), we create “guardrails” around that withdrawal rate. If your portfolio grows beyond an upper threshold, you may increase your income modestly; if it falls below a lower threshold, you temporarily draw from your Safety Warchest™ until your portfolio recovers.

Fund Your Freedom

With your essentials covered and guardrails in place, we plan for bucket-list trips, family giving, and the joys that make retirement fulfilling. We meet 3–4 times per year to review your WAF™, adjust as needed, and keep you on track.

Why it works?

✔︎ Smooths Out Volatility: Your Safety Warchest™ means you don’t sell into a downturn.

✔︎ Adapts to Markets: Guardrails help you increase income in good years and pause or trim in tough years—automatically.

✔︎ Aligns with Your Goals: We tailor guardrail widths to your risk comfort and equity mix, so your plan feels right for you.

Retire with Confidence. Live with Freedom.

Your WAF™ is a simple, powerful way to create reliable retirement income while protecting against market risk. Built on sound investment principles and personalized to your life, it helps you fund the lifestyle you want today—and preserve the wealth you need for tomorrow.

Ready to live your freedom years with clarity? Let’s build your plan together.

We feel your investment portfolio should not only grow but provide cash flow to you.

Here’s why…

Regardless of the direction of markets (up, down, or sideways), you usually have use for cash. So why shouldn’t your portfolio have a fairly reliable amount of cash flow that it generates for you?

That being said, we construct investment portfolios with this in min: “total return is a function of three components.”

Delta or "change in price/value". Delta has empirically been measured as about 8-10% for stocks and 3-4% for bonds. The question is why don't clients with a 60-40 portfolio achieve between a 6-8% return every year? Subsequently, doubling their money every 9-12 years? It is because most investors think they can beat the market. If you rely on the data that to construct this part of your portolio you have about 100 years of evidence to support you.

Gamma or "cashflow". This is the Greek letter that takes expertise (i.e. something you should be willing to pay for). The goal of a portfolio manager is to minimize downside risk while generating enough cash flow for the portfolio to continue to grow (with or without distributions) on an annual basis.

Theta or "compound interest". In some circles, compound interest has been referred to as the 8th wonder of the world. It plays a significant part in the portfolio and when combined with the gamma, allows for you to control 2/3rds of your portfolio's return--a compelling notion when you consider that most investors generate sub-optimal results year after year.

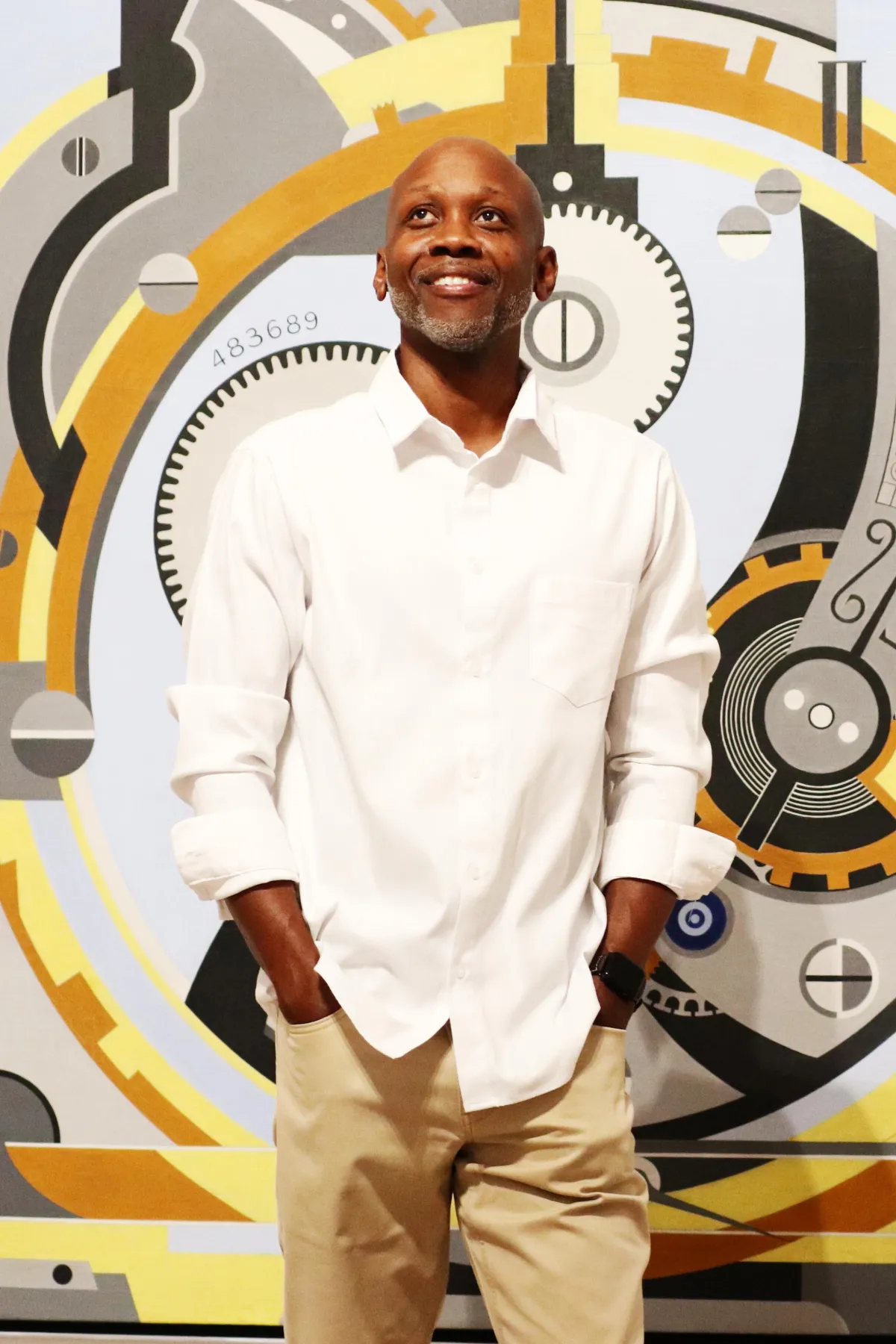

Who is Dominique and what is DJH Capital Management?

Our founder, Dominique (or “Dom”) is a husband (to Briana) and father to 3 adult children. He’s built a career in financial services that is over two decades long and includes time spent with hedge funds, broker-dealers, and large investment advisory teams.

Dom’s approach is very consultative and relational—a benefit of running a boutique-style firm that allows each client to be treated more like family.

Dom is the founder and 100% owner of DJH Capital Management, LLC. (“the firm”)—a registered investment advisory firm offering comprehensive financial planning and investment advisory services in states and other jurisdictions where exempted.

Opinions expressed on this website are not intended to be a solicitation for the purchase/sale of securities.

Any advice rendered should be considered dynamic in nature and strictly for the use of clients of the firm.

All responses to inquiries to the firm for the rendering of comprehensive financial planning or investment advisory services will be in accordance with federal and state guidelines where applicable. You can

What are some of the services you offer?

Our firm is intentional about meeting each client where they are. There are a variety of stages you may go through in your financial life and we attempt to identify where you are during the initial discovery meeting.

Here are some common planning scenarios we deal with:

Creating a Family Bank Solution to Build Generational Wealth (click to learn more)

Paying Less in Tax with Proactive Tax Planning (click to learn more)

15 Retirement Questions You Must Ask Yourself! (click to learn more)

To receive our insights, join our email list! (Click here)

To learn more about the services we offer, CLICK HERE to watch these YouTube videos.

Would you like a partner?

Information is everywhere. YouTube this. Google that.

That’s why we’re in the advice business.

We believe that determining your “why” is just as or even more important than figuring out the “how”.

If you’re looking to partner with a firm that understands that helping you achieve your financial goals starts with relationship, we would love to hear from you.

DJH Capital Management, LLC (“the Firm”) is a registered investment advisory firm offering comprehensive financial planning and investment advisory services in those states and other jurisdictions where exempted.

Opinions expressed on this website are not intended to be a solicitation for the purchase or sale of any security. Any advice or strategies presented are dynamic in nature and are strictly for use by clients of the Firm.

-No Guarantee: Past performance is no guarantee of future results. All investing involves risk, including possible loss of principal.

-Not an Offer: This content is for informational purposes only and does not constitute individualized investment advice or an offer to sell securities.

-Consult Your Advisors: You should consult your financial, tax, and legal advisors before implementing any strategy discussed here.

DJH Capital Management, LLC. © 2026 | All Rights Reserved | Privacy Policy